Beginning with Risk management framework, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

In today’s dynamic business landscape, the need for robust risk management frameworks has become paramount. Organizations across industries are recognizing the importance of proactively identifying, assessing, and mitigating risks to ensure sustainable growth and resilience. This Artikel delves into the core components of risk management frameworks and explores how they play a pivotal role in safeguarding organizational interests amidst uncertainty and volatility.

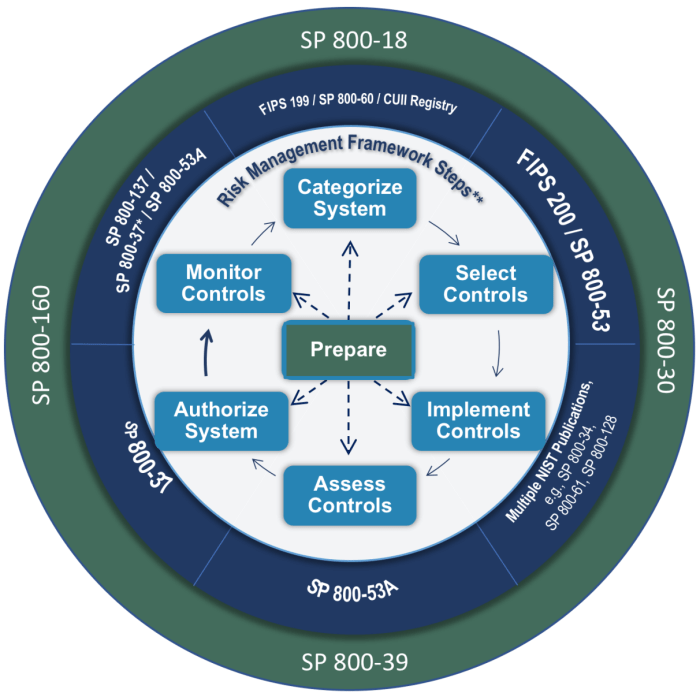

Risk Management Framework

A risk management framework is a structured process that organizations implement to identify, assess, and prioritize risks, as well as develop strategies to mitigate or manage them effectively.

Establishing a risk management framework is crucial for organizations to proactively identify potential risks that could impact their operations, finances, reputation, and overall success. It allows them to anticipate and address challenges before they escalate into major issues.

Types of Risk Management Frameworks

- Enterprise Risk Management (ERM): ERM encompasses a holistic approach to risk management, considering risks at all levels of an organization and across various functions. It focuses on identifying, assessing, and managing risks that could affect strategic objectives.

- Operational Risk Management: This framework concentrates on identifying and mitigating risks associated with day-to-day operations, processes, and systems within an organization. It aims to ensure the continuity and efficiency of business activities.

- Financial Risk Management: Financial risk management frameworks focus on identifying and managing risks related to financial activities, such as market risk, credit risk, liquidity risk, and operational risk. Organizations use financial risk management to safeguard their financial stability and performance.

- IT Risk Management: IT risk management frameworks are designed to identify and manage risks related to information technology systems, cybersecurity threats, data breaches, and technology failures. These frameworks aim to protect sensitive data and ensure the security of IT infrastructure.

Risk Assessment

Risk assessment is a crucial step within a risk management framework that involves identifying, analyzing, and evaluating potential risks that could impact an organization’s objectives. By conducting risk assessment, organizations can proactively manage and mitigate risks to minimize negative impacts on operations, finances, and reputation.

Tools and Techniques for Risk Assessment

- SWOT Analysis: A strategic planning tool that identifies an organization’s Strengths, Weaknesses, Opportunities, and Threats.

- Delphi Technique: A method for gathering input from experts to reach a consensus on potential risks.

- Interviews and Surveys: Engaging with stakeholders to gather insights on risks and their potential impacts.

- Checklists: Structured lists used to systematically identify and assess risks based on predefined criteria.

- Brainstorming: A creative technique to generate a wide range of potential risks and vulnerabilities.

Role of Risk Assessment in Identifying and Prioritizing Risks

Risk assessment plays a crucial role in helping organizations identify and prioritize risks by providing a systematic approach to understanding the likelihood and impact of each risk. By assessing risks, organizations can prioritize their resources and efforts towards mitigating the most critical and high-priority risks that could have a significant impact on the organization’s objectives. Additionally, risk assessment helps in developing risk treatment plans and implementing appropriate risk responses to effectively manage and reduce the overall risk exposure of the organization.

Risk Management

Risk management is a crucial aspect of any organization’s operations, as it involves identifying, assessing, and prioritizing risks to minimize their impact on the business. Effective risk management ensures that potential threats are mitigated and allows for better decision-making processes.

Key Components of Effective Risk Management

- Identification of Risks: The first step in risk management is to identify all potential risks that could affect the organization.

- Assessment of Risks: Once risks are identified, they need to be assessed in terms of their likelihood and potential impact on the business.

- Risk Mitigation Strategies: Implementing strategies to mitigate risks, such as transferring, avoiding, or reducing them through various control measures.

- Monitoring and Review: Regular monitoring and review of risks to ensure that the risk management framework is effective and up-to-date.

Implementation of Risk Management Strategies

Risk management strategies are implemented by creating a detailed plan that Artikels how risks will be addressed and mitigated. This plan should include specific actions, responsibilities, and timelines for each risk identified. By proactively implementing these strategies, organizations can reduce the likelihood of risks materializing and minimize their impact on operations.

Best Practices for Monitoring and Controlling Risks

- Regular Risk Assessments: Conducting regular risk assessments to identify new risks and reassess existing ones is essential for effective risk management.

- Communication and Reporting: Ensuring clear communication and reporting mechanisms for all stakeholders to keep them informed of any changes in the risk landscape.

- Training and Education: Providing training and education to employees on risk management practices to increase awareness and promote a risk-aware culture within the organization.

- Continuous Improvement: Constantly reviewing and improving risk management processes based on feedback and lessons learned from past experiences.

Risk Tolerance

Risk tolerance refers to the level of risk that an organization is willing to accept or take on in pursuit of its objectives. It plays a crucial role in risk management by helping organizations determine the amount of risk they are comfortable with and can handle.

Establishing and Measuring Risk Tolerance Levels

Risk tolerance levels are typically established through a combination of factors, including organizational goals, industry standards, regulatory requirements, and stakeholder expectations. These levels are measured using quantitative and qualitative methods to assess the organization’s capacity to withstand risk exposure.

- Quantitative methods involve using metrics such as financial ratios, key performance indicators, and risk assessment tools to quantify the organization’s risk appetite.

- Qualitative methods, on the other hand, rely on subjective assessments, expert judgment, and scenario analysis to evaluate the organization’s risk tolerance in non-financial terms.

Impact on Decision-Making and Risk Management Strategies

Risk tolerance directly influences decision-making processes and the development of risk management strategies within an organization. Organizations with a high risk tolerance may be more inclined to pursue aggressive growth strategies or investments, while those with a low risk tolerance may prioritize risk mitigation and conservative approaches.

Understanding and aligning risk tolerance with organizational objectives is essential for effective risk management and decision-making.

As organizations navigate an increasingly complex risk environment, the implementation of a well-defined risk management framework emerges as a strategic imperative. By adhering to best practices and fostering a culture of risk awareness, businesses can not only anticipate potential threats but also capitalize on emerging opportunities with confidence and agility. Embracing a comprehensive risk management framework is not merely a choice but a necessity in today’s unpredictable landscape where proactive risk mitigation is synonymous with sustainable success.

Common Queries

What is the primary purpose of a risk management framework?

A risk management framework serves as a structured approach to identifying, assessing, and mitigating risks to enhance organizational resilience and decision-making.

How does risk tolerance influence risk management strategies?

Risk tolerance defines an organization’s readiness to accept risk levels and influences the decision-making process by determining acceptable risk exposure thresholds.

What are some common tools used for risk assessment within a framework?

Tools such as risk matrices, scenario analysis, and SWOT analysis are commonly employed for risk assessment to evaluate potential threats and opportunities.

Why is monitoring and controlling risks essential in risk management?

Monitoring and controlling risks are crucial to track risk exposure levels, implement timely interventions, and ensure that risk mitigation strategies remain effective and aligned with organizational objectives.