Kicking off with Risk assessment vs risk management, this opening paragraph is designed to captivate and engage the readers, providing a glimpse into the key disparities between the two fundamental concepts in the realm of business risk management.

As we delve deeper into the intricacies of risk assessment and risk management, it becomes apparent that each plays a crucial role in safeguarding businesses against potential threats and uncertainties.

Risk Assessment

In a business context, risk assessment plays a crucial role in identifying, analyzing, and evaluating potential risks that could impact the organization’s objectives. By conducting a risk assessment, businesses can proactively address threats and opportunities, leading to more informed decision-making and effective risk management strategies.

Purpose of Risk Assessment

Risk assessment aims to:

- Identify potential risks that could affect the organization.

- Analyze the likelihood and impact of these risks.

- Evaluate the significance of each risk to prioritize mitigation efforts.

Tools and Methods for Conducting Risk Assessments

Risk assessments can be conducted using various tools and methods, such as:

- SWOT Analysis: Identifying Strengths, Weaknesses, Opportunities, and Threats.

- Failure Mode and Effects Analysis (FMEA): Evaluating potential failure modes and their effects.

- Risk Matrix: Assessing risks based on likelihood and impact.

- Scenario Analysis: Considering different scenarios and their potential outcomes.

Importance of Involving Key Stakeholders

Involving key stakeholders in the risk assessment process is essential as it:

- Brings diverse perspectives and expertise to the assessment.

- Ensures that all relevant risks are identified and evaluated.

- Fosters buy-in and commitment to risk management strategies.

- Enhances the overall effectiveness of risk assessment and management efforts.

Risk Management

Risk management is the process of identifying, assessing, and prioritizing risks followed by coordinated and economical application of resources to minimize, monitor, and control the probability or impact of unfortunate events. It is a crucial aspect of organizational management as it helps in mitigating potential threats and uncertainties that could impact the achievement of objectives.

Common Strategies and Techniques

- Risk Identification: This involves recognizing and documenting potential risks that could affect the organization.

- Risk Assessment: Evaluating the identified risks in terms of their likelihood and impact on the organization.

- Risk Mitigation: Developing and implementing strategies to reduce the probability or impact of risks.

- Risk Monitoring: Regularly tracking and reviewing risks to ensure that the mitigation strategies are effective.

- Contingency Planning: Creating backup plans to deal with potential risks if they materialize.

- Risk Transfer: Transferring the risk to a third party, such as through insurance or outsourcing.

Role in Decision-Making Processes

Risk management plays a crucial role in the decision-making processes within organizations by providing a structured approach to assessing and addressing potential risks. By identifying and evaluating risks, organizations can make informed decisions that take into account the potential impact of uncertainties. This helps in minimizing the negative consequences of risks and maximizing opportunities for success.

Risk Tolerance

In the context of risk management, risk tolerance refers to the level of risk that an organization is willing to accept or take on in pursuit of its objectives. It is a crucial aspect of the risk management process as it helps organizations determine the amount of risk they are comfortable with and can afford to withstand.

Factors influencing an organization’s risk tolerance level

- The nature of the industry: Certain industries, such as finance or healthcare, inherently involve higher levels of risk due to regulatory requirements or market volatility.

- Organizational culture: Companies with a more risk-averse culture may have lower risk tolerance levels compared to those that encourage innovation and experimentation.

- Financial strength: Organizations with strong financial reserves may have a higher risk tolerance as they can better withstand potential losses.

- Growth objectives: Companies aiming for rapid growth may be more willing to take on higher risks to achieve their expansion targets.

Impact of risk tolerance on an organization’s overall risk management strategy

- Risk appetite alignment: Understanding risk tolerance helps organizations align their risk appetite with their strategic goals, ensuring that risk-taking is in line with overall objectives.

- Risk mitigation strategies: Organizations with low risk tolerance levels may focus more on risk avoidance or mitigation strategies to reduce exposure to potential threats.

- Resource allocation: Risk tolerance influences resource allocation decisions, as organizations with higher risk tolerance levels may allocate more resources to high-risk, high-reward initiatives.

Risk Mitigation

Risk mitigation is a crucial aspect of risk management that involves taking proactive steps to reduce or eliminate the potential impact of identified risks. It is a strategy aimed at minimizing the likelihood of risks occurring and the severity of their consequences.

Implementing Risk Mitigation Strategies

Effective implementation of risk mitigation strategies is essential across various business sectors to safeguard operations and assets. Here are some ways to implement risk mitigation:

- Identify and prioritize risks: Conduct a thorough risk assessment to identify potential risks and prioritize them based on their impact and likelihood of occurrence.

- Develop risk mitigation plans: Create detailed plans outlining specific actions to be taken to reduce or eliminate identified risks.

- Allocate resources: Allocate sufficient resources, including finances, personnel, and technology, to implement risk mitigation measures effectively.

- Training and awareness: Provide training to employees on risk management practices and create awareness about potential risks and their mitigation strategies.

- Regular review: Continuously monitor and review the effectiveness of risk mitigation measures to ensure they remain relevant and up to date.

Importance of Monitoring and Evaluating Risk Mitigation

Monitoring and evaluating the effectiveness of risk mitigation measures are critical to ensuring the success of risk management efforts. It helps in:

- Assessing the impact: Determine the actual impact of implemented risk mitigation strategies on reducing risks and improving overall resilience.

- Identifying gaps: Identify any gaps or weaknesses in existing risk mitigation plans and take corrective actions to address them.

- Continuous improvement: Use insights from monitoring and evaluation to continuously improve risk mitigation strategies and adapt to changing risk scenarios.

- Compliance requirements: Ensure that risk mitigation measures comply with regulatory requirements and industry standards to avoid potential penalties or legal issues.

In conclusion, the dynamics between risk assessment and risk management underscore the importance of a comprehensive approach to risk mitigation in organizations. By understanding the nuances of these processes, businesses can proactively address challenges and seize opportunities for sustainable growth and success.

FAQ Section

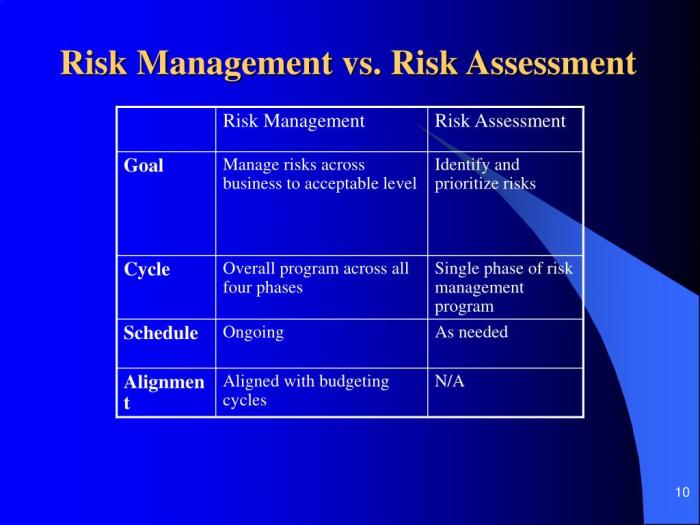

What is the main difference between risk assessment and risk management?

Risk assessment focuses on identifying potential risks, while risk management involves taking steps to mitigate those risks and minimize their impact on the organization.

How do key stakeholders contribute to the risk assessment process?

Key stakeholders provide valuable insights and perspectives that help in identifying, assessing, and prioritizing risks effectively.

What role does risk tolerance play in an organization’s risk management strategy?

Risk tolerance influences how much risk an organization is willing to accept in pursuit of its objectives, shaping its approach to risk management and decision-making.

Why is monitoring and evaluating risk mitigation measures important?

Continuous monitoring and evaluation ensure that the implemented risk mitigation strategies are effective and adaptive to changing risk landscapes, enhancing overall risk management practices.