Delving into the realm of Risk Tolerance Level, this discussion unveils the crucial aspects of navigating investment risks with precision and insight.

Exploring the intricate relationship between risk tolerance and investment decisions, this narrative seeks to shed light on the pivotal role it plays in the financial landscape.

Introduction to Risk Tolerance Level

When it comes to investments, risk tolerance level refers to an individual’s ability and willingness to handle the fluctuations and uncertainties associated with investing. It is a crucial factor that helps determine the appropriate investment strategy for each person.

Understanding your risk tolerance level is important as it helps you make informed decisions about where to allocate your money. By knowing how much risk you can comfortably take on, you can tailor your investment portfolio to align with your financial goals and personal preferences.

Importance of Understanding Individual Risk Tolerance

Having a clear understanding of your risk tolerance level allows you to create a diversified investment portfolio that suits your comfort level. It ensures that you do not take on more risk than you can handle, preventing unnecessary stress and potential financial losses.

- Knowing your risk tolerance helps you stay disciplined during market fluctuations, avoiding impulsive decisions based on emotions.

- It allows you to set realistic expectations for your investment returns, aligning them with your risk appetite.

- Understanding your risk tolerance also helps you communicate effectively with financial advisors or portfolio managers, ensuring they tailor their recommendations to your preferences.

Examples of How Risk Tolerance Affects Investment Decisions

Here are some scenarios that demonstrate how risk tolerance can influence investment decisions:

- Investors with a high risk tolerance may choose to allocate a significant portion of their portfolio to high-risk, high-reward assets such as stocks or cryptocurrencies.

- Conversely, individuals with a low risk tolerance may opt for safer investments like bonds or money market funds, prioritizing capital preservation over potential returns.

- During market downturns, those with a low risk tolerance may be more likely to panic and sell their investments, while those with a higher risk tolerance may see it as a buying opportunity.

Factors Influencing Risk Tolerance

Age, income, financial goals, past investment experiences, market conditions, and economic outlook are some of the key factors that influence an individual’s risk tolerance level.

Personal Factors

- Age: Younger individuals may have a higher risk tolerance as they have more time to recover from any potential losses. On the other hand, older individuals nearing retirement may have a lower risk tolerance to protect their savings.

- Income: Higher income individuals may be more willing to take risks with their investments compared to those with lower income levels.

- Financial Goals: The specific financial goals of an individual, such as saving for retirement or buying a home, can also impact their risk tolerance. Those with long-term goals may be more open to taking risks.

Impact of Past Investment Experiences

- Positive past investment experiences, such as successful trades or investments, may lead to a higher risk tolerance as individuals feel more confident in their decision-making abilities.

- Conversely, negative experiences, such as significant losses, can result in a lower risk tolerance as individuals become more cautious and risk-averse.

External Factors

- Market Conditions: The current state of the financial markets, including volatility and uncertainty, can influence risk tolerance. During bear markets, individuals may become more risk-averse.

- Economic Outlook: Factors like inflation, interest rates, and geopolitical events can impact an individual’s perception of risk and affect their risk tolerance level.

Assessing Risk Tolerance

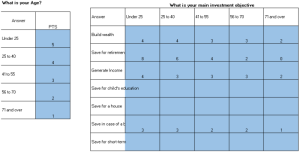

Determining an individual’s risk tolerance is crucial in the investment process as it helps in creating a suitable investment strategy that aligns with their comfort level. There are various methods to assess risk tolerance, including questionnaires and risk assessment tools, as well as scenarios that can provide valuable insights.

Risk Tolerance Questionnaires vs. Risk Assessment Tools

Risk tolerance questionnaires are commonly used to gauge an individual’s risk appetite by asking a series of questions related to their financial goals, investment experience, time horizon, and willingness to take risks. These questionnaires are subjective and rely on self-assessment.On the other hand, risk assessment tools use algorithms and statistical models to evaluate risk tolerance based on quantitative data and market research.

These tools provide a more objective assessment by analyzing factors such as asset allocation, volatility, and historical performance.

Examples of Scenarios to Determine Risk Tolerance Levels

1. Market Volatility

Presenting scenarios where the market experiences significant fluctuations can help assess how comfortable an individual is with the ups and downs of investing.

2. Loss Aversion

Creating scenarios where there is a possibility of loss can reveal whether an individual is risk-averse or willing to take on higher risks for potential rewards.

3. Time Horizon

Considering different investment timeframes and scenarios can help determine if an individual is more inclined towards long-term investments or short-term gains.By utilizing a combination of risk tolerance questionnaires, risk assessment tools, and real-life scenarios, investors can gain a comprehensive understanding of their risk tolerance levels and make informed investment decisions accordingly.

Managing Risk Tolerance

Managing risk tolerance is crucial in ensuring that your investment portfolio aligns with your financial goals and comfort level with risk. By employing effective strategies and regularly reassessing your risk tolerance, you can optimize your investment decisions for long-term success.

Aligning Investments with Risk Tolerance

When aligning investments with your risk tolerance level, it is essential to diversify your portfolio. Diversification involves spreading your investments across different asset classes, industries, and geographic regions to reduce the impact of any single investment’s performance on your overall portfolio. This strategy helps mitigate risk and can enhance long-term returns.

The Role of Diversification

- Diversification is a key component of managing risk as it helps spread risk across different investments.

- By investing in a variety of assets, you can reduce the impact of market volatility on your portfolio.

- Proper diversification can provide a more stable and consistent return over time.

Periodic Reassessment of Risk Tolerance

Regularly reassessing your risk tolerance is essential for long-term investments. As your financial situation, goals, and risk preferences may change over time, it is crucial to review and adjust your risk tolerance accordingly. This periodic reassessment ensures that your investment strategy remains in line with your objectives and helps you make informed decisions to achieve your financial goals.

In conclusion, grasping the nuances of risk tolerance level is paramount for making informed investment choices and ensuring long-term financial stability.

Expert Answers

What factors influence an individual’s risk tolerance?

Factors such as age, income, financial goals, and past investment experiences can significantly impact one’s risk tolerance.

How can risk tolerance be effectively assessed?

Risk tolerance can be assessed through various methods, including questionnaires, risk assessment tools, and analyzing specific scenarios.

Why is periodic reassessment of risk tolerance important?

Periodic reassessment ensures that investments align with current risk tolerance levels and helps in managing risks effectively over the long term.